You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sample Society

- Thread starter Souly

- Start date

Help Support Makeuptalk.com forums:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Joined

- Jan 16, 2012

- Messages

- 6,107

- Reaction score

- 101

Right? I could survive it, but my wallet can't. I need a raise lol, not sure how my boss would take that request. "Can you pay me more so I can buy more make up? Thanks."

- Joined

- Dec 27, 2011

- Messages

- 4,330

- Reaction score

- 46

Originally Posted by Playedinloops /img/forum/go_quote.gif

Right? I could survive it, but my wallet can't. I need a raise lol, not sure how my boss would take that request. "Can you pay me more so I can buy more make up? Thanks."

Girl, I'm sayin! Of course, we just found out we are getting some pretty nice bonuses next month. So I see another large purchase in April! LOL

- Joined

- Jan 16, 2012

- Messages

- 6,107

- Reaction score

- 101

lol! My tax return should be coming soon, but I need to pay off my credit cards first. THEN STOP USING THEM TO BUY MAKE UP, lol.

LOL My tax refund came yesterday and what's funny when I don't have money to burn I see so much stuff I WANT but when I have money I never want to buy. lolOriginally Posted by Playedinloops /img/forum/go_quote.gif

lol! My tax return should be coming soon, but I need to pay off my credit cards first. THEN STOP USING THEM TO BUY MAKE UP, lol.

- Joined

- Jan 16, 2012

- Messages

- 6,107

- Reaction score

- 101

Originally Posted by zadidoll /img/forum/go_quote.gif

LOL My tax refund came yesterday and what's funny when I don't have money to burn I see so much stuff I WANT but when I have money I never want to buy. lol

Isn't that the way it always goes? Of course, I need new spring clothes too...why is shopping so addictive.

$35.99 ($3.60 / Count)

$44.87 ($4.49 / Count)

Jessup Makeup Brushes Set 10pcs, Double Sided Foundation Contour Blush Highlight Blending Eyebrow Brush Eyeshadow Eyeliner Concealer Brush, Bright Cyan Cruelty Free Cosmetic Tools T500

Jessup beauty

$16.99 ($2.12 / Count)

ENERGY Colorful Rainbow Makeup Powder Brushes Set With Case Beauty Tools with Foundation Face Blending Blush Concealer Brow Eye Shadow Brushes Essential Cosmetics for Girl Women (8 Pcs)

ENERGY Makeup Brush Store

$24.99 ($8.33 / Count)

Vtopmart 3 Tier Clear Makeup Organizer with Drawer, Cosmetic Storage for Dresser Countertop and Bathroom Vanity, Beauty Holder for Lipstick Brush Skincare

Vtopmart Direct

$18.90

$27.00

Robert Jones' Makeup Masterclass: A Complete Course in Makeup for All Levels, Beginner to Advanced

Amazon.com

$12.99 ($0.72 / Count)

BS-MALL Makeup Brush Set 18 Pcs Premium Synthetic Foundation Powder Concealers Eye shadows Blush Makeup Brushes with black case

BS-MALL Direct

$11.99

$14.99

Masisrs Clear Makeup Organizer - Cosmetic Storage Organizer - 16 Compartments - Easily Sort Make Up & Jewelry - 4 Drawer Vanity Organizer - Elegant Look - Transparent Design - Makeup Holder

Handy Laundry Products Corp.

$22.99

$26.99

Makeup Organizer with 3 Drawers, Cosmetic Display Cases, Makeup Storage Box (3 Drawers) (white)

PTBSZCWY Home

$18.49 ($0.74 / Count)

$21.99 ($0.88 / Count)

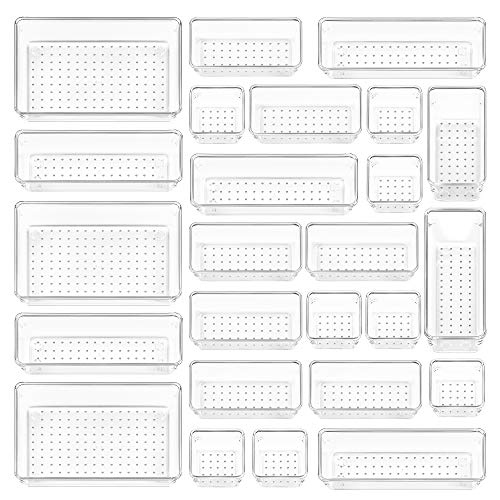

Vtopmart 25 PCS Clear Plastic Drawer Organizers Set, 4-Size Versatile Bathroom and Vanity Drawer Organizer Trays, Storage Bins for Makeup, Bedroom, Kitchen Gadgets Utensils and Office

Vtopmart Direct

$26.99 ($6.75 / Count)

$45.98 ($11.50 / Count)

Vtopmart 4 Pack Clear Stackable Storage Drawers, 4.4'' Tall Acrylic Bathroom Makeup Organizer,Plastic Storage Bins For Vanity, Undersink, Kitchen Cabinets, Pantry, Home Organization and Storage

Vtopmart Direct

GirlyEnthusiast

Mastiff Momma

Jealous! I haven't gotten a tax refund since I was like, 17 lol. I owe big bucks every year. If only Mastiffs were tax write-offs :/Originally Posted by Playedinloops /img/forum/go_quote.gif

lol! My tax return should be coming soon, but I need to pay off my credit cards first. THEN STOP USING THEM TO BUY MAKE UP, lol.

- Joined

- Jan 16, 2012

- Messages

- 6,107

- Reaction score

- 101

Originally Posted by GirlyEnthusiast /img/forum/go_quote.gif

Jealous! I haven't gotten a tax refund since I was like, 17 lol. I owe big bucks every year. If only Mastiffs were tax write-offs :/

ha, well I file single 0 so that I pay too much in to get some back. Its like a savings account I can't touch, lol.

- Joined

- Jan 25, 2012

- Messages

- 118

- Reaction score

- 9

Quote:

Originally Posted by zadidoll /img/forum/go_quote.gif

LOL My tax refund came yesterday and what's funny when I don't have money to burn I see so much stuff I WANT but when I have money I never want to buy. lol

Yep, it's like Murphy's Law. I'm so stoked for my tax return. I expected to pay taxes on some contracting work; I didn't realize I could write off business expenses while still claiming the standard deduction, woo!

I definitely upped by cosmetics budget for the month when I saw I was getting money back, heh.

Originally Posted by zadidoll /img/forum/go_quote.gif

LOL My tax refund came yesterday and what's funny when I don't have money to burn I see so much stuff I WANT but when I have money I never want to buy. lol

Yep, it's like Murphy's Law. I'm so stoked for my tax return. I expected to pay taxes on some contracting work; I didn't realize I could write off business expenses while still claiming the standard deduction, woo!

I definitely upped by cosmetics budget for the month when I saw I was getting money back, heh.

EXACTLY like Murphy's Law. lolOriginally Posted by randerso /img/forum/go_quote.gif

Yep, it's like Murphy's Law. I'm so stoked for my tax return. I expected to pay taxes on some contracting work; I didn't realize I could write off business expenses while still claiming the standard deduction, woo!

I definitely upped by cosmetics budget for the month when I saw I was getting money back, heh.

GirlyEnthusiast

Mastiff Momma

Originally Posted by Playedinloops /img/forum/go_quote.gif

ha, well I file single 0 so that I pay too much in to get some back. Its like a savings account I can't touch, lol.

Haha that's smart. I do "independent contracting" so I get a ton of 1099s at the end of the year.

I hate 1099s. I really do. Such a pain because you have to go file a schedule C with it. It's bad enough I have to file a Schedule C when I do my husband's business tax returns but to do one for a 1099 is an absolute PAIN.

- Joined

- Jan 16, 2012

- Messages

- 6,107

- Reaction score

- 101

You guys are making me so glad my aunt works for h&r block. I just hand everything over and she takes care of it...for free lol. I did some "independent contracting" when I was tutoring through a website in college, and that was such a pain in the butt. Never again, lol.

GirlyEnthusiast

Mastiff Momma

I don't even want to know what's involved in filing 1099s, calculating business expenses, etc... thank gawd I have a friend who is an accountant and files my returns for free. I did buy a house in 2010 so at least now I have one big write off.. mortgage interest!

GirlyEnthusiast

Mastiff Momma

You can write off appliances? I bought my house new, so it came with the stainless appliances and crap already.. but I wouldn't mind trading those puppies in and upgrading if it meant I could write it off  /emoticons/[email protected] 2x" width="20" height="20" />

/emoticons/[email protected] 2x" width="20" height="20" />

- Joined

- Jan 25, 2012

- Messages

- 118

- Reaction score

- 9

I have never heard of writing off appliances but it's possible. This is my reference list:Originally Posted by GirlyEnthusiast /img/forum/go_quote.gif

You can write off appliances? I bought my house new, so it came with the stainless appliances and crap already.. but I wouldn't mind trading those puppies in and upgrading if it meant I could write it off/emoticons/[email protected] 2x" width="20" height="20" />

Automobile expense Equipment and furniture (must be depreciated) Office supplies Postage and delivery Continuing education Home office deduction Utility expense (energy, water, wireless)

I loooooove doing my taxes, I would never let anyone else touch them. But then again I am going into accounting so that is probably a good thing.

GirlyEnthusiast

Mastiff Momma

I've always been afraid of using the home office write-off because I've heard that is a red flag for the A word... lolOriginally Posted by randerso /img/forum/go_quote.gif

If your contracting work involves working from home, you can pretty much write off a portion of anything you purchase involving your work. Rent expense, mortgage, utilities, wireless service, laptop, computer accessories, office supplies, etc. Appliances might be iffy unless you are a personal cook, lol.

I loooooove doing my taxes, I would never let anyone else touch them. But then again I am going into accounting so that is probably a good thing.

- Joined

- Jan 25, 2012

- Messages

- 118

- Reaction score

- 9

Originally Posted by GirlyEnthusiast /img/forum/go_quote.gif

I've always been afraid of using the home office write-off because I've heard that is a red flag for the A word... lol

I know what you mean, the correct percentage for home office write offs is very subjective ... subjective and the IRS don't mix, haha.

GirlyEnthusiast

Mastiff Momma

LOL truer words were never spoken!Originally Posted by randerso /img/forum/go_quote.gif

I know what you mean, the correct percentage for home office write offs is very subjective ... subjective and the IRS don't mix, haha.